Life Insurance Leads

The Life Insurance Industry

*Disclaimer: we do not buy or sell leads. This page is an overview of the life insurance lead generation industry.

Life insurance is a trillion-dollar industry, according to IBIS World, and it is expected to grow. As the median age of the population increases and disposable income rises, life insurance has become a more desirable commodity. However, finding potential customers is not always simple. Unlike a mortgage deal, where lenders are similar, selling life insurance requires finding high-intent individuals. Because of this, many insurance agents and brokers rely on life insurance lead generation to fuel their growth and build a sustainable book of business.

Types of Life Insurance Leads

Not all leads are created equal. When building a strategy, you need to understand the lead type and vertical you are pursuing for high conversion rates.

- Exclusive Life Insurance Leads: These are sold to only one agent. Because the consumer isn't being called by ten different companies, these often result in the highest quality interactions.

- Shared Life Insurance Leads: Unlike exclusive life insurance leads, these are sold to multiple agents.

- Online Leads: Generated via web forms where a user requests a life insurance quote. These provide digital contact information immediately.

- Inbound Phone Calls: These are often the highest quality leads because the customer is actively reaching out to speak with an agent in real-time. Make sure you have a call routing system to be able to handle them in the best way.

- Aged Leads: These are older leads (often 90+ days). While they are cheaper, they require a higher volume of outreach to find a "diamond in the rough."

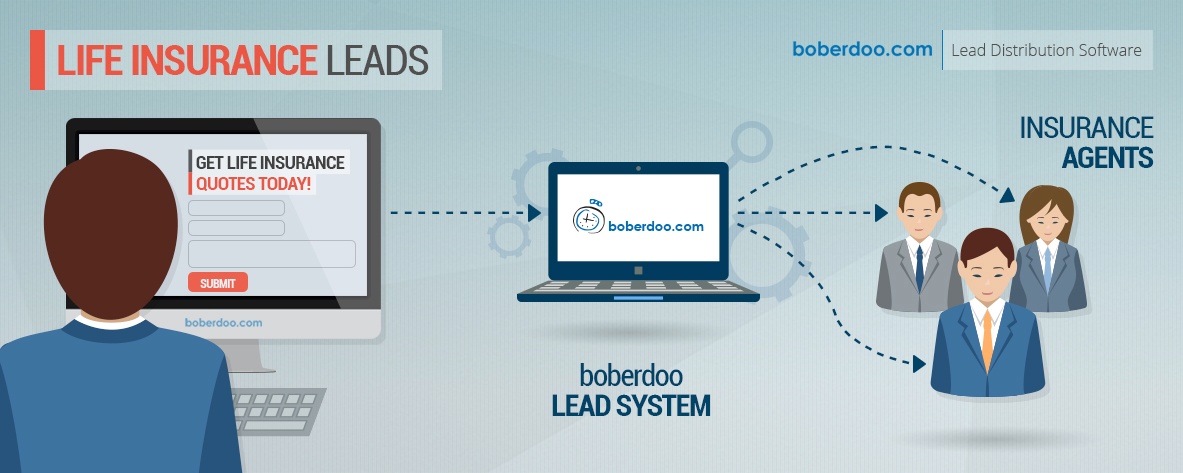

How Life Insurance Lead Generation Works

The goal is to connect a consumer looking for coverage with an agent who can provide it. The process generally follows these steps:

- Attracting Interest: You use ads or content to find people searching for a life insurance quote.

- Capturing Data: The prospect provides their contact information through an online lead form or initiates phone calls.

- Real-Time Delivery: To maintain high quality, the lead must be delivered to an agent instantly. This is usually done via ping post software.

- The Sale: The agent uses the high-intent data to close the deal, improving their overall conversion rates.

How to Start: 3 Pillars of Success

If you are just starting out in the life insurance lead generation space, these three areas will determine your success:

1. Focus on Data Quality

To sell leads to insurance agents, you must provide accurate contact information. Using verification tools to scrub for "bot" traffic or fake numbers to make sure you are delivering a high-quality product that agents will buy again.

2. Speed to Contact (The 5-Minute Rule)

In 2026, the "speed to lead" is the most important metric. When a prospect requests a life insurance quote, their intent is at its peak. If an agent doesn't initiate phone calls within the first five minutes, the chance of a conversion drops. Your lead distribution system must route data in real-time.

3. Compliance and Ethics

The industry is highly regulated. Make sure all online lead capture forms are TCPA compliant. This means clearly stating that the user is consenting to be contacted by an agent. Proper documentation protects both the lead generator and the buyer.

Optimizing for High-Quality Leads

For insurance agents, the "holy grail" is a lead that is both high quality and exclusive. When a lead is delivered in real-time with accurate contact information, the chances of a successful sale skyrocket.

If you are a lead generator, focusing on high-intent traffic, people specifically looking for terms like "best term life policy", so that the potential customers you pass along are ready to buy. If you are buying or selling, make sure you're using a quality checker.

Common Mistakes Beginners Make

- Buying "Shared" Leads Too Often: While cheaper, shared leads often lead to a "race to the bottom" where the consumer is annoyed by too many calls.

- Ignoring Follow-Up: Many potential customers don't buy on the first call. A structured follow-up sequence is required to maintain high conversion rates.

- Not Testing Ad Copy: To get high-intent traffic, your ads should mention specific benefits (e.g., "Protect your family for $1/day") rather than generic "Buy Insurance" headlines.

How boberdoo Can Help

The boberdoo system and its ping post technologies are the standard in the industry. With the most advanced ping post options, custom deliveries to any CRM or LMS and a plethora of billing options, boberdoo provides a complete back end system for running not only your life insurance lead vertical, but your entire lead business. If you are looking to upgrade your lead generation business or break into the life insurance vertical, you can do no better than boberdoo.com. If you would like to discuss life insurance leads, ping post or the boberdoo lead distribution system, please give us a call at 800-776-5646.

Our company builds lead distribution software for lead generation companies. We also have a few other services such as leadQC. We DO NOT SELL life insurance leads. If you are looking to purchase leads, please submit an inquiry and tell us who your current suppliers are and we can make introductions to boberdoo clients in that vertical.

Life Insurance Lead Generation FAQ

Here are the answers to the most common questions about life insurance lead generation and how insurance agents can effectively reach potential customers. This section covers everything from ensuring lead quality to maximizing your conversion rates in real-time.